10 Things Global News - 31 July 2025

News that matters from around the world

Senate Rejects Israel Arms Ban as Democrats Divide

Kremlin Says Russia Is Immune to New U.S. Sanctions Threat

Trump Hits Brazil With New Tariffs, Escalating Trade Spat

Canada to Recognize Palestinian State If Reforms Are Met

Fed Holds Rates Steady, Resists Trump’s Push for Cuts

Trump Hits India With 25% Tariff Over Russia Ties

Gaza Aid Queue Turns Deadly as U.S. Envoy Heads to Israel

U.S. Economy Rebounds in Q2, Growth Driven by Import Drop

Taiwan Scales Up Drone Force as China Threat Looms

China Summons Nvidia Over Security Concerns in AI Chips

The U.S. Senate on Wednesday rejected two resolutions aimed at halting a $676 million weapons deal with Israel, but the vote revealed growing divisions among Democrats over the Gaza conflict. Senator Bernie Sanders led the push to block the sale of 5,000 heavy bombs, guidance kits, and tens of thousands of assault rifles, citing humanitarian concerns in Gaza. While both resolutions were defeated — 70–27 and 72–24 — 27 Democrats supported the measures, up from 15 in April and 19 in November.

The shift marks a notable erosion in Israel’s once-solid bipartisan support in Washington. Prominent Democrats like Jeanne Shaheen and Jack Reed backed the embargo, alongside independents Angus King and Sanders. Sanders argued the sales would breach U.S. legal obligations, as American-supplied arms have allegedly been used in strikes on Palestinian civilians. However, every Senate Republican voted to maintain the deal, and Democratic leaders like Chuck Schumer and Cory Booker also opposed the resolutions, underscoring that congressional backing for Israel remains largely intact despite mounting dissent.

Sources: Axios, Politico

The Kremlin on Wednesday dismissed U.S. President Donald Trump’s latest threat of sanctions, claiming Russia has developed “immunity” after years under Western restrictions. Trump said new tariffs and punitive measures would begin in 10 days unless Moscow makes progress toward ending its war in Ukraine. Kremlin spokesperson Dmitry Peskov said Russia’s economy had long operated under “a huge number of restrictions” and had adapted to such conditions.

Foreign Ministry officials echoed the sentiment, calling the threat routine and ineffective. They argued that sanctions have failed to change Russian behavior and instead hurt Western economies. Meanwhile, Russian strikes continued in Ukraine, with missile attacks on Kyiv killing six and injuring over 40. In a related development, President Zelenskyy announced he had approved large-scale U.S.-Ukraine arms agreements, though details were not disclosed. The Kremlin also criticized a diplomatic visit to Geneva, where sanctioned Russian officials attended a parliamentary event, prompting backlash from Putin critics.

Sources: Reuters, The Guardian

President Trump on Wednesday imposed sweeping new tariffs and sanctions targeting Brazil, copper imports, and global e-commerce flows, intensifying a politically charged trade offensive. Brazil will face a 50% tariff on select goods starting in October, in what critics describe as retaliation for the prosecution of Trump ally Jair Bolsonaro. The U.S. also sanctioned Brazilian Supreme Court Justice Alexandre de Moraes and imposed a visa ban over his role in the Bolsonaro trial. Key Brazilian exports like orange juice and aircraft are exempt, but coffee will be hit.

Separately, Trump announced 50% tariffs on semi-finished copper products, effective August 1. Refined copper, however, is excluded, causing prices to plunge. A long-standing duty-free import rule known as the de minimis exemption was also suspended, targeting cheap e-commerce shipments. Trump cited national security and unfair treatment of U.S. companies, though many analysts viewed the measures as politically motivated. Brazil’s president condemned the moves as foreign interference.

Sources: CNN, BBC

Prime Minister Mark Carney announced Wednesday that Canada will recognize the state of Palestine in September at the UN General Assembly—provided the Palestinian Authority commits to a set of political reforms. These include holding general elections in 2026, excluding Hamas from governance, and agreeing to demilitarization. Carney said the shift reflects growing urgency to preserve the two-state solution, which he warned is “receding before our eyes.”

The move aligns Canada with France, the UK, and other nations that have recently signaled recognition of Palestinian statehood amid rising humanitarian concerns in Gaza. Carney held talks with Palestinian leader Mahmoud Abbas before the announcement and coordinated with leaders from Britain and France. The Israeli government rejected the decision, calling it a reward for terrorism. Canada also pledged $10 million for Palestinian Authority reform efforts and $30 million in humanitarian aid. The decision is likely to inflame tensions with Washington and deepen domestic political divisions.

Sources: CBC, New York Times

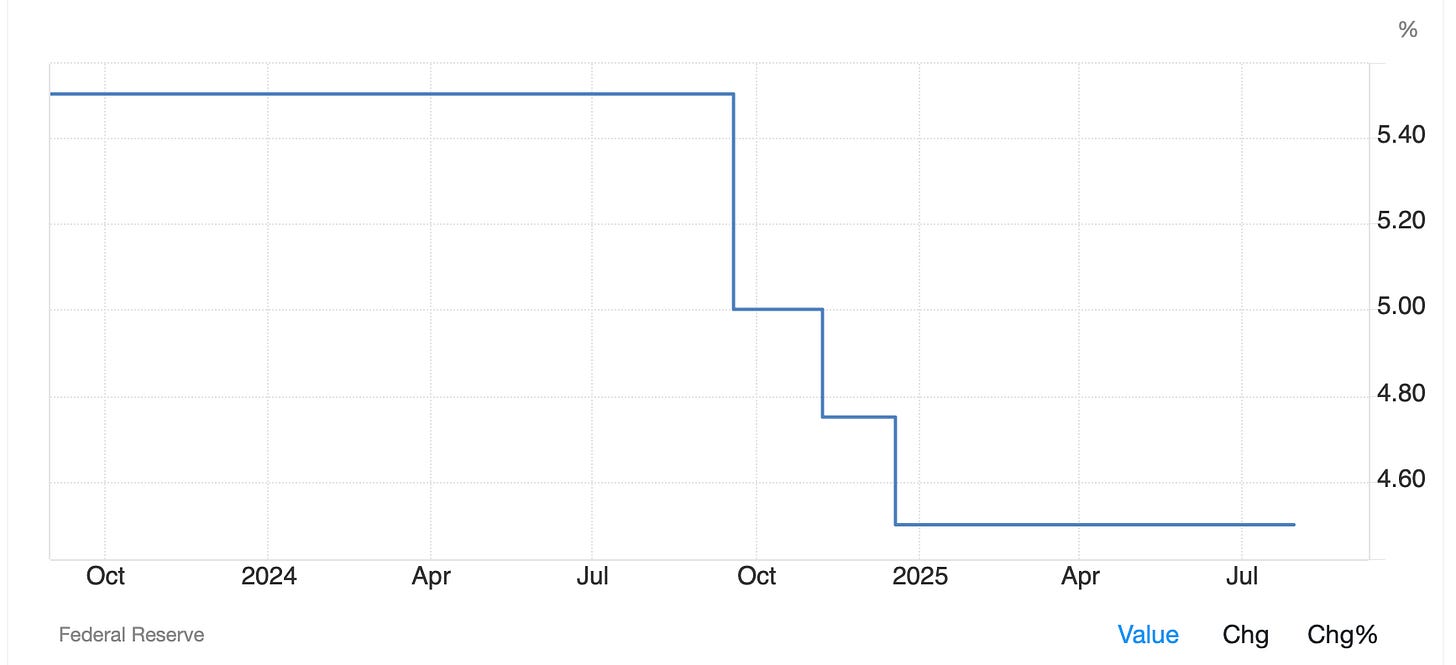

The Federal Reserve left interest rates unchanged on Wednesday, resisting pressure from President Trump and signaling no clear path to a September cut. Chair Jerome Powell said the central bank remains focused on containing inflation, which is running above its 2% target, and warned that it is too early to assess the economic impact of new tariffs and policy shifts.

The policy decision passed 9–2, with two Trump-appointed governors dissenting in favor of an immediate cut. It marked the first double dissent from Fed governors in over three decades. Markets reacted swiftly: expectations for a September cut dropped below 50%, Treasury yields rose, and major U.S. stock indexes fell.

Powell said the Fed would await more data, including inflation and job reports, before reconsidering its stance. While acknowledging political pressure, he emphasized that premature rate cuts could reignite inflation, while waiting too long might harm employment — a balance the Fed aims to manage cautiously.

Sources: Global Banking and Finance, Bloomberg

President Trump announced a 25% tariff on Indian exports to the U.S., citing India’s high trade barriers and continued purchases of Russian oil and weapons. The tariff, set to take effect August 1, is the highest imposed among America’s major trading partners, with others such as Japan and South Korea securing 15% rates through recent negotiations. Trump framed the move as both a trade and geopolitical penalty, linking it to India’s close military and energy ties with Moscow.

Indian officials expressed disappointment but said trade talks remain ongoing. The two sides had been working toward a fall agreement, but negotiations recently stalled over agricultural issues and U.S. demands for wider market access. India is the largest buyer of Russian energy after China and sources over a third of its arms from Russia. The tariff announcement caused India’s currency and stock futures to fall, raising fears of wider economic fallout if exemptions are not secured.

Sources: CNBC, Bloomberg

At least 48 Palestinians were killed and dozens more wounded by gunfire while waiting for food near the Zikim crossing in northern Gaza, according to hospital reports. The Israeli military acknowledged firing warning shots but said casualty claims “do not align” with its information. The incident is part of a growing pattern; more than 1,000 Palestinians have reportedly died trying to access food aid since May, amid ongoing conflict and logistical chaos.

Israel has recently eased some restrictions on aid, but UN officials say deliveries remain far below the 500-truck daily target. Aid convoys are frequently overwhelmed by crowds, and multiple deaths have occurred near both UN and Israeli-backed distribution sites. Malnutrition deaths are rising, with at least 89 children among the 150+ fatalities since the war began.

U.S. envoy Steve Witkoff is set to arrive in Israel Thursday to discuss humanitarian concerns. Meanwhile, Canada has joined France and the UK in supporting Palestinian statehood recognition.

Sources; Associated Press, BBC

The U.S. economy expanded at a 3% annual rate in the second quarter, recovering from a 0.5% contraction in Q1, according to new data released Wednesday. While the headline figure signals strength, economists cautioned that the rebound was largely driven by a steep drop in imports — a statistical quirk that inflates GDP. Imports, which subtract from GDP, fell by 30% after new tariffs took effect, reversing a Q1 surge.

Consumer spending rose 1.4%, up from 0.5% in the previous quarter, while business investment slowed sharply, increasing just 1.9% compared to 10% earlier in the year. A narrower measure of underlying demand — final sales to private domestic purchasers — rose only 1.2%, the weakest since 2022.

Analysts noted that the data reflects a fragile balance: growth is continuing, but signs of slowing demand and inflationary pressure remain. Economists expect the full-year pace to fall below 2024’s 2.8% growth rate.

Sources: CBS, Axios

Taiwan has launched its most ambitious drone expansion yet, aiming to acquire over 100,000 unmanned systems as part of a sweeping effort to deter potential Chinese aggression. The strategy includes military-grade UAVs, maritime drones, and dual-use commercial models, all tailored to Taiwan’s rugged geography and asymmetric defense posture. Taipei sees drones as central to its “porcupine strategy” — making any attempted invasion too costly for China’s military, which ranks third globally.

Recent deals include 48,750 military drones and 50,000 additional units for infrastructure and homeland defense. However, experts warn Taiwan’s production targets still fall short of real-world needs, citing Ukraine’s consumption of drones in daily combat. Domestic manufacturing faces hurdles from supply chain reliance on China and the lack of combat-tested systems. While drone exports are rising, logistical gaps, financial risk, and strategic ambiguity still hinder full preparedness. A summit-level task force and partnerships with allies aim to close those gaps.

Sources: Al Jazeera, Defence Blog

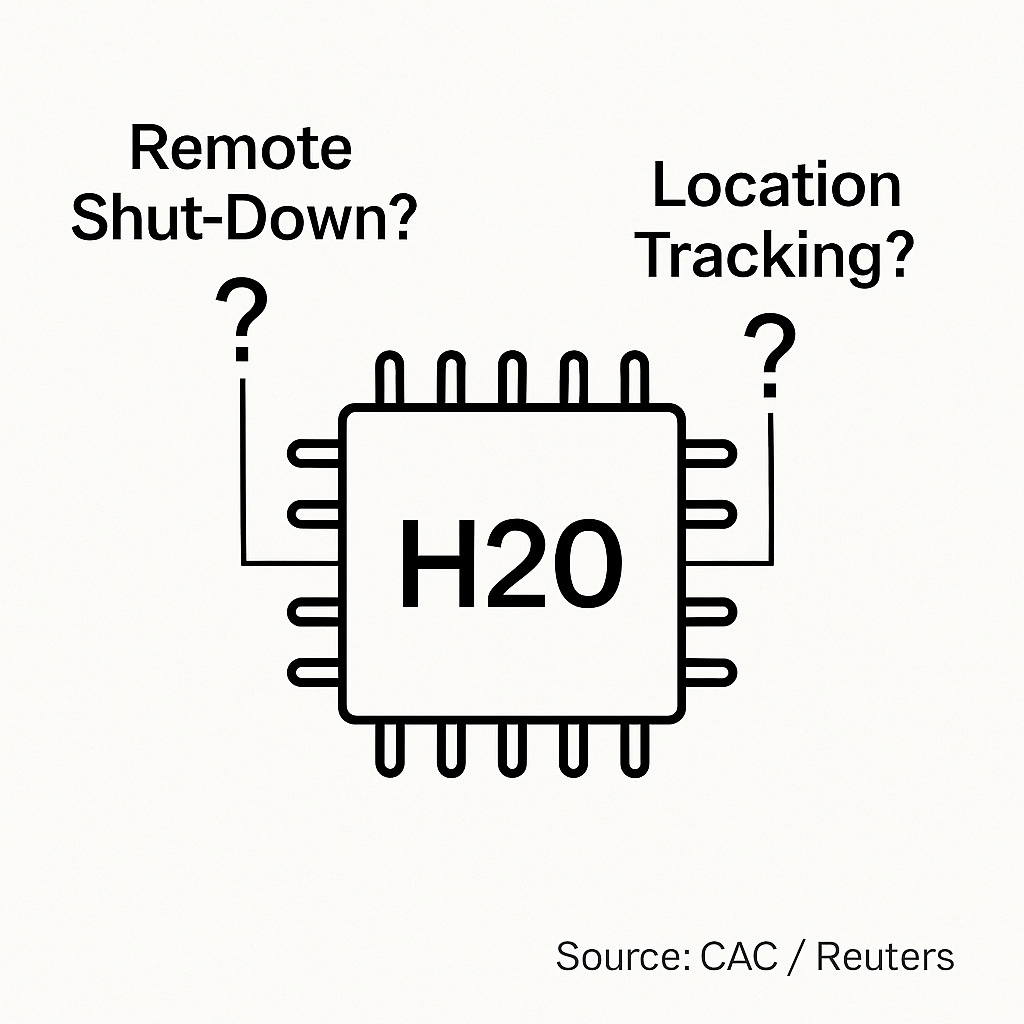

China’s cyberspace regulator has summoned Nvidia to address alleged security risks in its H20 AI chips, raising new barriers for the U.S. chipmaker’s efforts to re-establish sales in the Chinese market. The Cyberspace Administration of China cited concerns that the chips may include location tracking and remote shutdown capabilities, posing potential threats to user privacy and data security. Nvidia was asked to submit documentation explaining these features and their compliance with local standards.

The H20 chip was designed to comply with U.S. export restrictions and had just re-entered the Chinese market after a ban was lifted this month. Nvidia CEO Jensen Huang recently visited Beijing to reaffirm the company’s commitment, but the inquiry has reignited tensions. The U.S. Congress is also weighing legislation that would require AI chips sold abroad to include location verification mechanisms. Meanwhile, Chinese tech firms have accelerated efforts to replace Nvidia with domestic alternatives amid geopolitical uncertainty.